Are you looking to buy a home in Warner Robins but worried about your credit score? Don’t worry, you’re not alone. Your credit score plays a significant role in your ability to secure a home mortgage. In this article, we’ll cover everything you need to know about credit scores, minimum credit scores for home mortgages, and how to build credit in Warner Robins. Your local Real Estate Agent can refer you to good lenders that can help.

What lenders see in your credit score

When applying for a home mortgage, your credit score will be a significant factor that lenders consider. Your credit score reflects your ability to pay back the loan as agreed and on time. The higher your credit score, the better chance you have of securing a home mortgage with a low-interest rate. On the other hand, a low credit score may result in higher interest rates or even the denial of your home mortgage application.

Warner Robins is a growing city with a population of approximately 84,000 residents. The median home value in Warner Robins is climbing thru $200,000, and the homeownership rate is 54.6%, but Warner Robins still holds a lower median home value compared to other cities in Georgia. This makes owning a home in Warner Robins more achievable than other locations. However, it’s essential to understand the minimum credit score requirements for a home mortgage in Warner Robins.

Minimum Credit Scores for Home Mortgages in Warner Robins

The minimum credit score required for a home mortgage varies depending on the type of loan you are applying for. Although none of these loan programs like going below about 620, some will still qualify a borrower if they have good collateral (make a higher down payment) or pay a higher interest rate. The most common home mortgage loans are conventional, FHA, and VA loans.

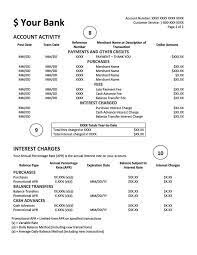

Home mortgage companies pull your credit from three mains sources; Transunion, Equifax and Experian. If any of these companies have a bad report on your account, it could hurt the other reports. Make sure to get a report and see how accurate your credit profile is. You can get a copy of your report from;

Some may not give a Beacon Score, but they will show your full account history.

Building Your Credit Score in Warner Robins

If you’re looking to improve your credit score to qualify for a home mortgage in Warner Robins, there are several steps you can take:

- Start small: Apply for one small credit card (Walmart card, Sears card, Capital one Spark, etc.). Charge a small amount and pay it off each month. Become an authorized user on someone else’s credit card. They may not allow you to use the card, but you will still benefit from their good credit… Assuming their credit is good.

- Pay your bills on time: Late payments can negatively impact your credit score. Set up automatic payments or reminders to ensure you pay your bills on time.

- Reduce your credit utilization: Your credit utilization is the percentage of available credit you are currently using. Aim to keep your credit utilization on each account below 30% to avoid negative impacts on your credit score.

- Standard and Revolving credit: Lenders like to see at least one revolving credit account (Line of credit, Credit card, etc.) and one standard loan (house, car, student loans that have structured loan payments).

Loans you can apply for

Conventional Loans

Conventional loans are not insured or guaranteed by the federal government, and they typically require a higher credit score compared to other types of loans. The minimum credit score required for a conventional loan is typically around 640, but some lenders may require a higher score. If you have a credit score below 640, expect some resistance.

Keep in mind that while a 640 credit score may be the minimum requirement, it’s essential to have a higher credit score to secure a better interest rate. For example, a credit score of 740 or higher may result in a lower interest rate and save you thousands of dollars over the life of your mortgage.

FHA Loans

FHA loans are insured by the Federal Housing Administration and are an excellent option for first-time homebuyers or those with a lower credit score. The minimum credit score required for an FHA loan is as low as 580, but some lenders may require a higher score. Again, a lower credit score may result in a higher interest rate or the requirement of a larger down payment.

USDA loans

USDA loan programs are only for rural areas and share similar qualifications as the FHA programs.

VA Loans

VA loans are available to veterans, active-duty military personnel, and their spouses. VA loans are guaranteed by the Department of Veterans Affairs and typically have more lenient credit score requirements. While there is no minimum credit score requirement for a VA loan, most lenders require a credit score of at least 620.

Conclusion

Apply for a few credit accounts and work on your credit every month. Once you have six months of good payments history, you should be ready to talk to the bank about your first house.

Good Luck

Share these additional articles

How much down payment do I need?